July 5, 2024

Report: The IRS has gotten better at helping rural and 'underserved' markets but still has room to improve

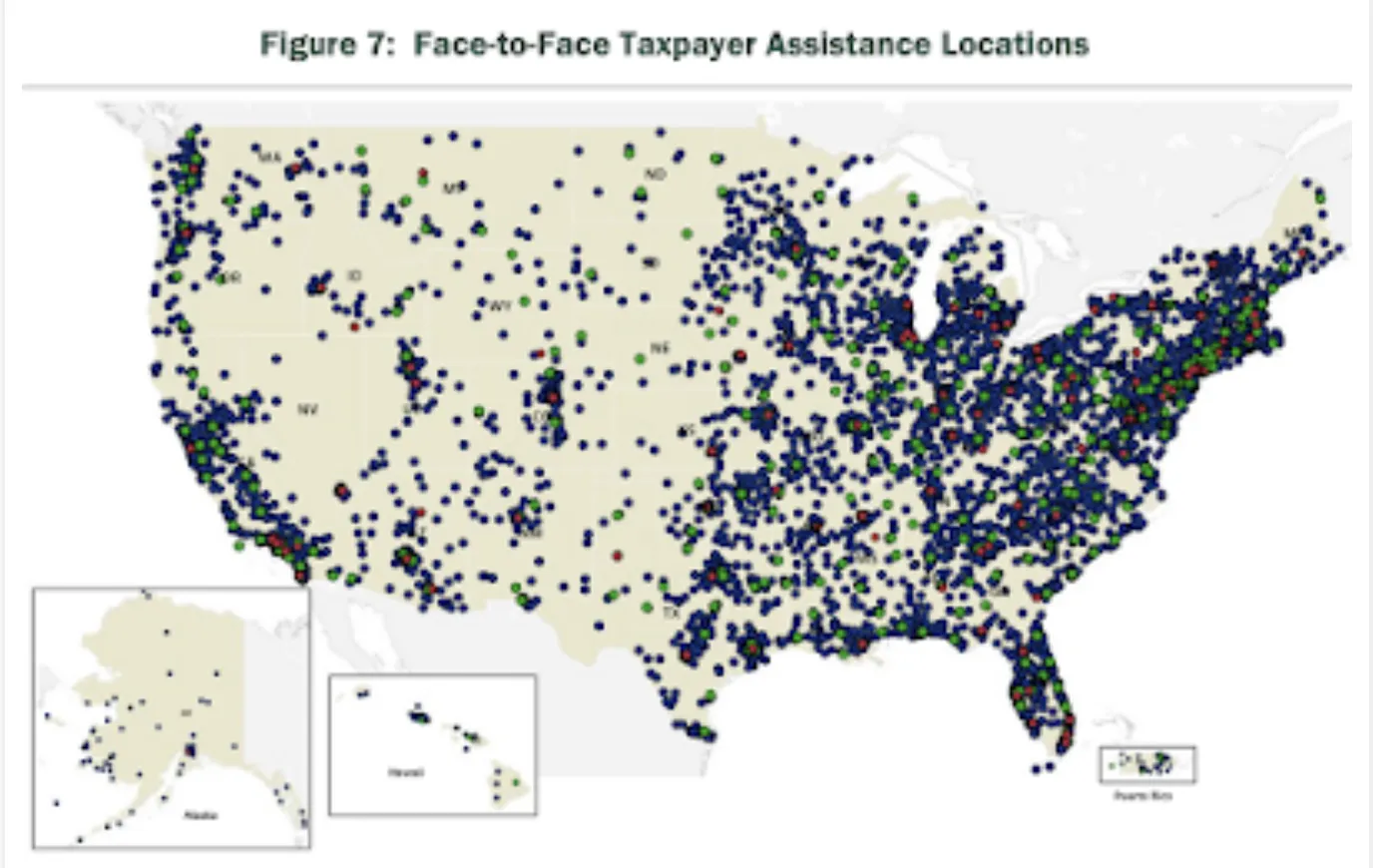

TIGTA analysis of IRS TAC, VITA, TCI and LITC locations and SSA shared office space by zip code.

For rural residents, getting help from the Internal Revenue Service might be a bit easier than it was a year ago; however, the agency still needs to improve its outreach to help "underserved" people, according to the Treasury Inspector General for Tax Administration. Sean Michael Newhouse of Government Executive reports, "A watchdog report published last week offered new insights on how the IRS can better use the nearly $58 billion in funding from the 2022 Inflation Reduction Act to improve taxpayer services for underserved, underrepresented and rural individuals."

While the TIGTA report recognized some improvements, it noted that the "IRS does not currently have a definition for what an underserved taxpayer is," Newhouse explains. "While IRS officials told investigators that they use different models to identify such taxpayers, the inspector general argued this practice has resulted in disparate definitions across the agency."

The report also recommended the agency use strategic communication tools to inform underserved residents about available tax assistance programs. Newhouse reports, "For example, investigators did not find any information on the IRS website about outreach events for rural taxpayers or the agency’s virtual assistance program. That being said, since the virtual service started in 2022, a total of 46 employees have helped more than 22,000 taxpayers."

Because reaching underserved populations is a challenge, investigators suggested the IRS piggyback its office locations with or near other government service offices, such as the Social Security Administration office.