July 15, 2024

When poverty is measured differently, a new and surprisingly poorer American picture emerges

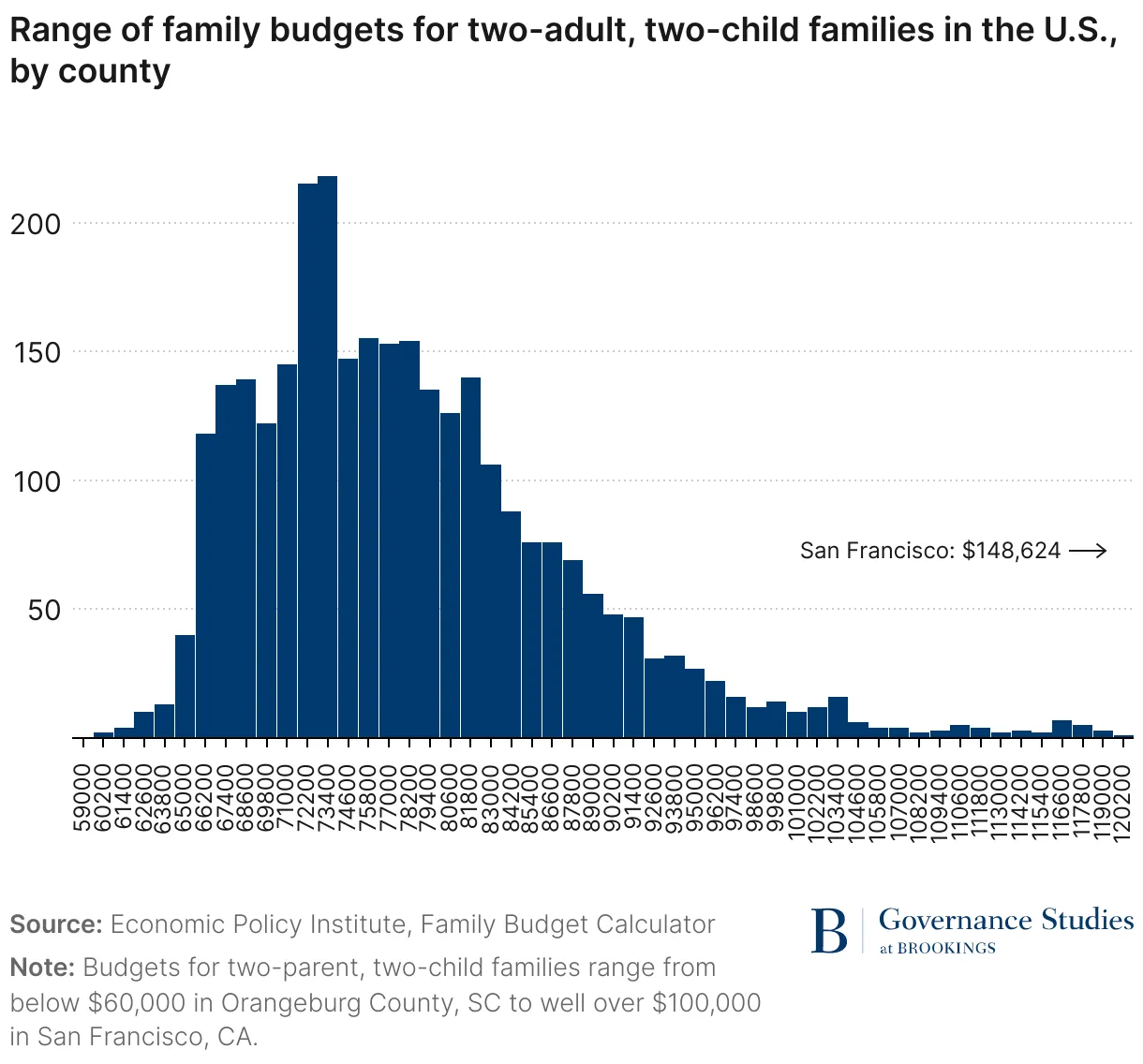

Range of family budgets for 2-adult, two-child families in the U.S., by county

Many Americans may look to the federal poverty rate as a way to measure how many U.S. citizens are living in need. Unfortunately, that snapshot is "just the tip of the iceberg," writes Jeffrey C. Fuhrer of Brookings in his blog. Fuhrer outlines why the the poverty rate, which doesn't vary from place to place, is a "woefully incomplete measure of economic need. A much more relevant benchmark is the cost of a basket of basic necessities. That benchmark, unlike the poverty threshold, varies dramatically by geography, as housing and other costs vary substantially from county to county. The cost of necessities far exceeds the poverty level for every family category in every county in the country."

When the ability of a family's income to meet basic needs is used to calculate how many American budgets fall short, a much different picture emerges. For a "shockingly high proportion of families, total family resources do not cover the expenses for these necessities. And that proportion rises significantly for families of color," Fuhrer adds. "Forty-three percent of all families in the U.S. fall short of meeting basic needs. And the legacy of institutional racism jumps out of these statistics: Across all family structures, 59% and 66% of Black and Hispanic families, respectively, have resources that fall short of basic family budgets, versus 37% of white families."

How do families manage to make do without? "As the interviewees in my recent book, The Myth That Made Us, attest, they use a variety of tactics to cope with life on or near the edge. To be sure, they scrimp on some necessities. Families can avoid spending on preventative health care, home maintenance (for the minority who own homes), auto maintenance and other necessary expenditures that can be deferred. They go into debt," Fuhrer explains. "All of these decisions bear important longer-term consequences. As a leading example, non-payment of rent often leads to eviction and the endless trauma that accompanies it."

By the numbers, the U.S. is the wealthiest country in the world, but many Americans are not sharing in that legacy. Fuhrer writes, "The huge numbers of families with low incomes, measured not relative to the poverty line but to quite conservative budgets, is staggering. . . "

To read Fuhrer's complete blog posting including supporting data and graphs, click here.